Selling your business requires careful preparation to maximize its value and attract the right buyers.

If you’re in the trades, you know the value of planning ahead. Just as you wouldn’t start a project without a plan, you shouldn’t rush into selling your business without a well-thought-out plan. If you are mulling over selling, here’s some advice to help you make good decisions.

Preparing to sell: Key considerations

1. Evaluate your business health

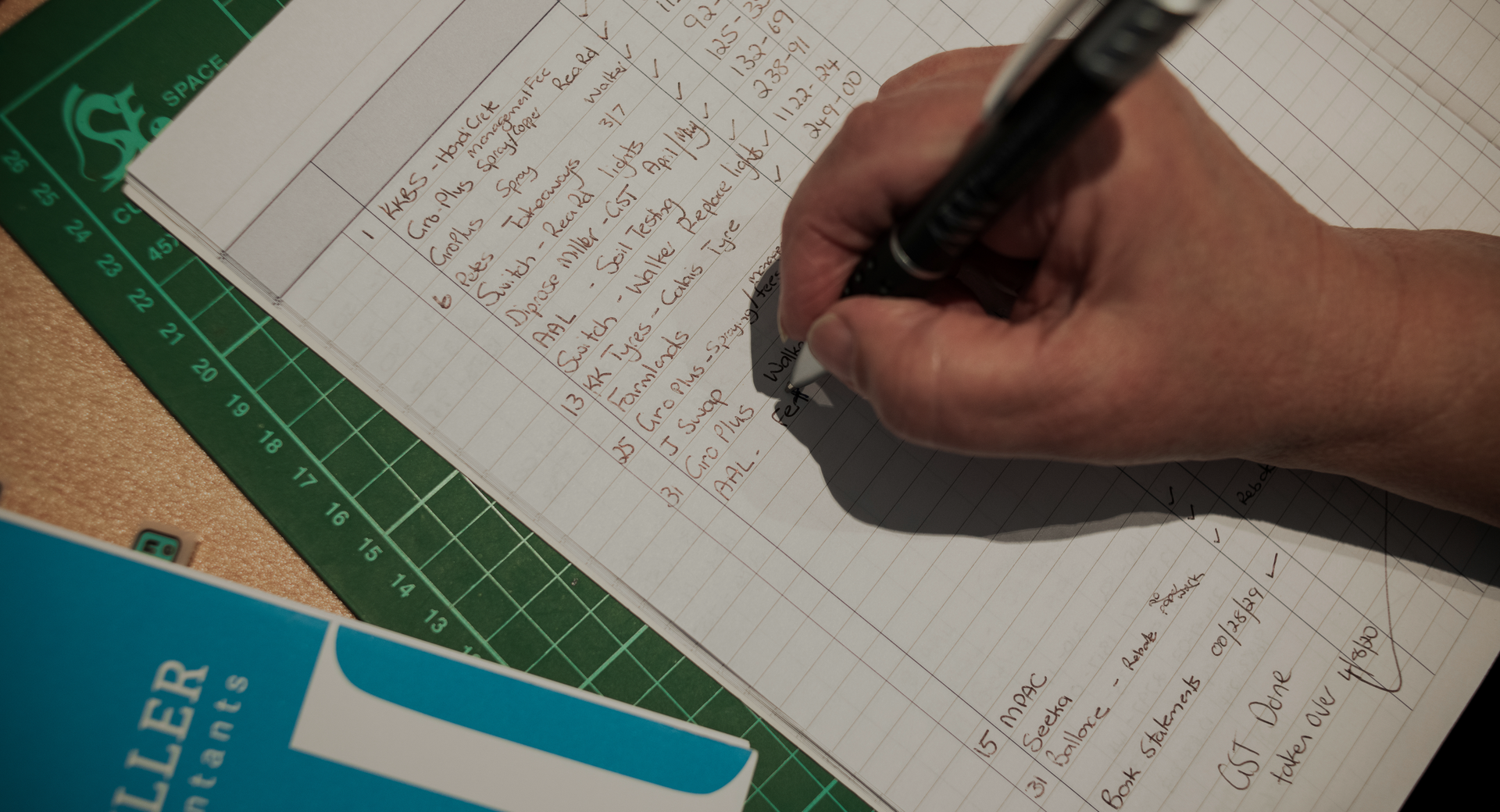

Start by assessing the current state of your business. This involves reviewing your financial statements, operational processes, and overall market position. Ensure your financial records are up-to-date and transparent. Potential buyers will scrutinize your books, so it’s crucial to have everything in order.

2. Understand your business’s worth

Determining the value of your business is essential. This might involve engaging an independent business valuer who can provide an objective assessment. They will consider factors such as your company’s earnings, assets, liabilities, and market conditions.

3. Plan your exit strategy

An exit strategy outlines how you will transition out of your business. This includes deciding whether you want a complete sale, a phased exit, or even selling to a family member or employee. Your exit strategy should align with your personal and financial goals.

4. Tax and legal implications

Consult with your accountant and a lawyer to understand the implications of selling your business. They can help you navigate complex issues, such as tax, transfer of ownership, and compliance with regulations.

Maximising business value

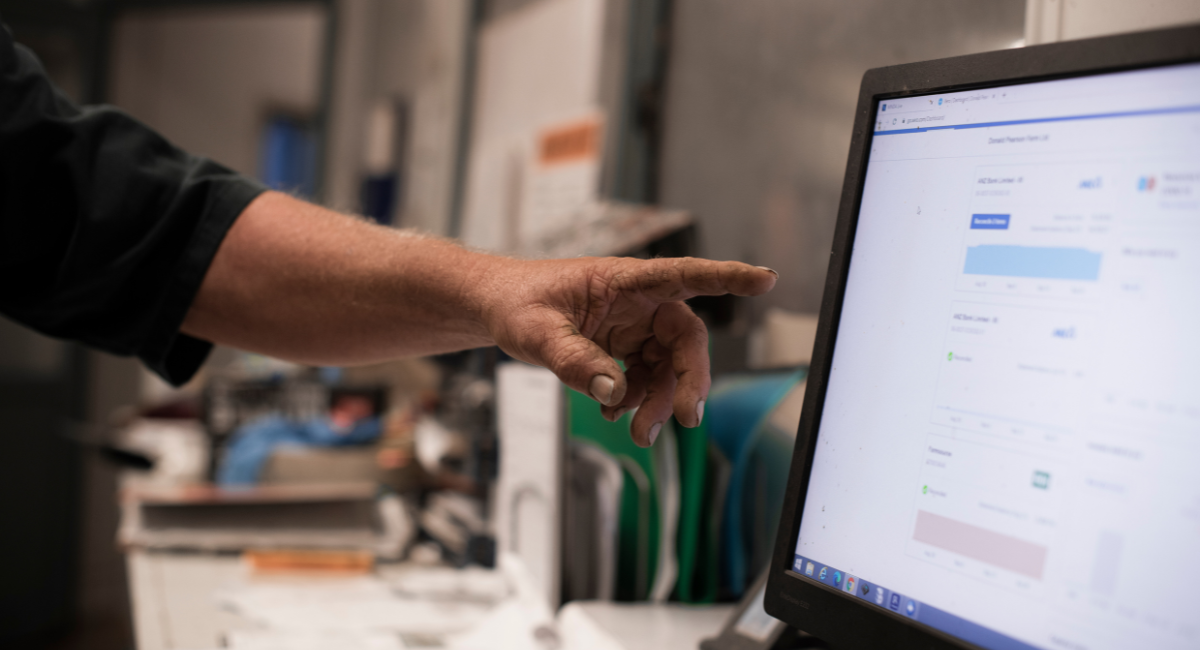

1. Streamline operations

Efficient operations make your business more attractive to buyers. Look for ways to improve processes, reduce costs, and enhance productivity. Implementing standard operating procedures (SOPs) can also show potential buyers that your business is well-organised and capable of running smoothly without you.

2. Boost your financial performance

Strong financial performance is a significant draw for buyers. Focus on increasing revenue and controlling expenses. Highlight any recurring revenue streams, such as maintenance contracts or long-term customer relationships, as these provide stability and predictability.

3. Enhance your brand and reputation

A solid reputation in the trades and construction industry can significantly increase your business’s value. Maintain high standards of workmanship, prioritise customer satisfaction, and actively seek positive reviews and testimonials. A well-regarded brand can be a valuable asset.

4. Diversify your client base

A diverse client base reduces risk and makes your business more appealing. Relying too heavily on a few key clients can be a red flag for buyers. Work on broadening your customer base to include a mix of residential and commercial clients, and perhaps even public sector contracts.

Attracting the right buyers

1. Market your business effectively

Selling a business is similar to marketing a service. Create a compelling information package that includes your business’s financials, a summary of operations, and growth potential. Highlight what makes your business unique and profitable.

2. Engage a business broker

A business broker can be invaluable in the selling process. They have the expertise and networks to find and vet potential buyers, ensuring you get the best deal possible. They also help maintain confidentiality, which is crucial to prevent any disruption to your business operations.

3. Negotiate wisely

When you receive offers, don’t just focus on the price. Consider other terms, such as payment structure, transition period, and any contingencies. Seek advice from advisors, like your accountant or lawyer. They can provide essential guidance during negotiations.

Moving forward

Selling your trades or construction business is a significant decision that requires careful planning and execution. By thoroughly preparing, enhancing your business’s value, and strategically marketing it to potential buyers, you can achieve a successful sale that meets your financial and personal goals.

Ready to take the next step?

Our team can help you navigate the complexities of selling your business, from valuation to finding the right buyer. Contact us today to start planning your successful exit strategy.