News

We share useful content to help you in your role as business owner or operator.

13 August 2025

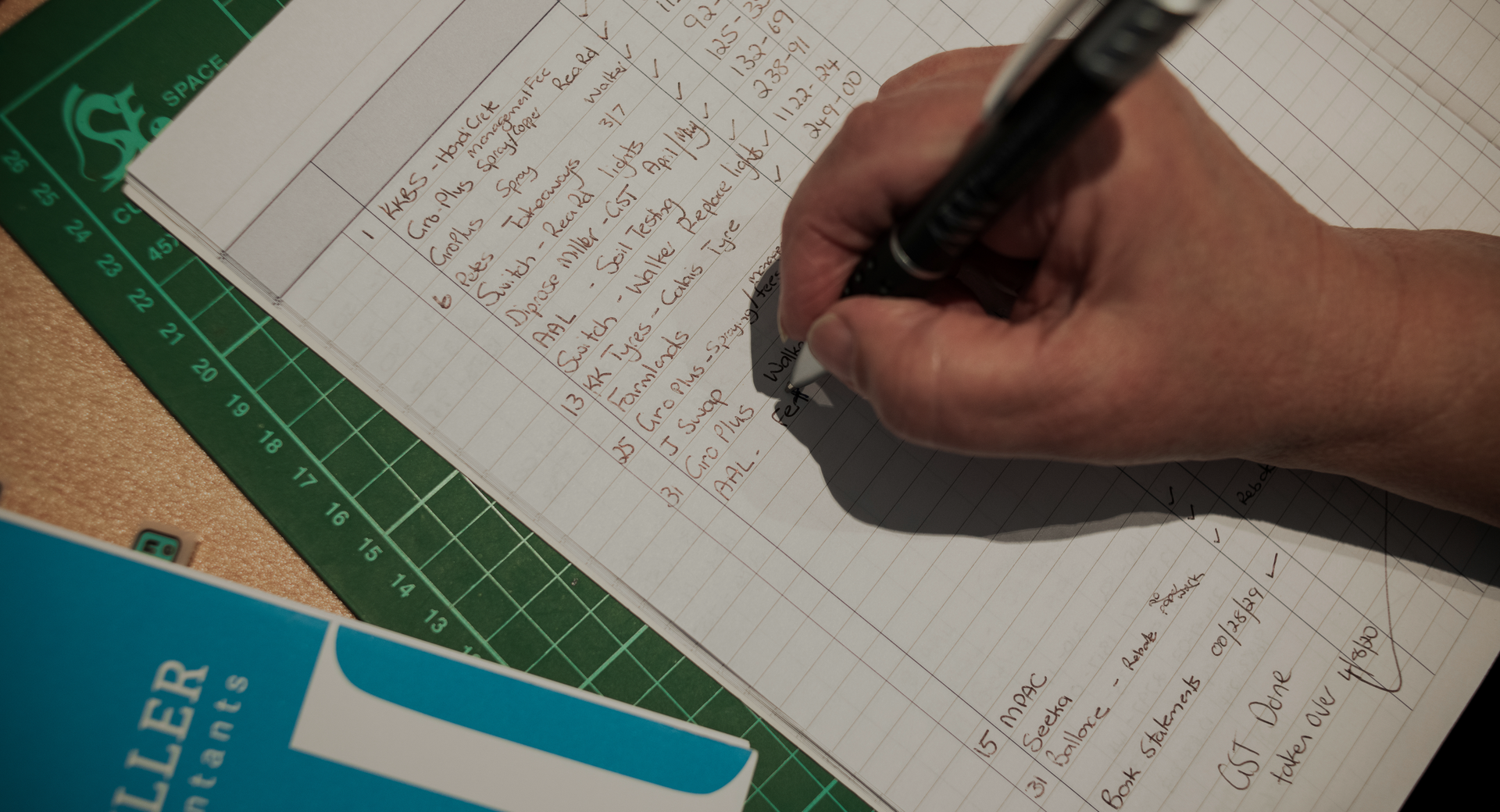

Keeping on top of the financial management of your business can be hard work. It's possible to have a profitable business that is struggling to find the cash flow to pay expenses and fund growth. Likewise, you could have positive cash flow but are not turning a profit, particularly if you are re-investing profits back into the capital expenditure. Turning a profit is at the heart of running any successful business But without an even and predictable flow of cash into the company, you can't cover your overheads, you can't pay your employees, and you can't run your day-to-day operations – let alone think about expanding and growing the business. In the end, you need both. But if you’re going to be in control of your financial destiny, it’s important to get your head around the important process of cash flow management. Let’s look at some of the key things to understand about your finances: Profit is a by-product of a successful business – as the owner, you want to make profits, but profitability isn’t the only goal. A business can easily be profitable, but also be highly unstable in the longer term. What you want is stability and consistent revenues. Cash flow keeps your business alive – good revenues (income) serve to bring cash into the business. Without cash to cover your operating expenses, you have no means to keep the lights on in the business. So cash really is king! Know your cost base and overheads – the flip side of your cash flow position is your costs. In an ideal world, you want more cash inflows than cash outflows, so it’s important to know your expenses and costs and to manage them carefully. Be proactive about spend management and easing expenditure – if you can take action that reduces your spending, that is hugely positive for your cash flow position. Choose cheaper suppliers, negotiate better deals and bring that cost base down. Drive more revenue, through increased sales and marketing activity – if you can increase your revenues, you also boost your cash flow. So it’s important to be proactive about running targeted sales and marketing campaigns to increase your sales. Keep the cash flowing and the profits take care of themselves – if you achieve the ideal cash flow position, the company sits on solid financial foundations, the cash is there for investment and the business can grow. It’s that simple. Talk to us about improving your cash flow management Whether you’re new to running a business, or a seasoned owner who needs some financial support, we can give you the cash flow advice you need. We’ll review your finances, delve down into your cash flow, and come up with key ways for you to increase your cash income and reduce your cash expenses. It only takes a few small changes to achieve a far better cash flow position for your business – helping you maintain positive cash flow AND generate profits.

13 August 2025

Sometimes you may pay your employees sums in addition to their normal wages, such as: allowances benefits holiday pay lump sum payments Some are tax free, but most are taxable. For some, the employer pays the associated tax. For others, the employer deducts PAYE on the employee's behalf. You may also provide various non-cash benefits to your employees as part of their total employment package. Even where the benefits are not in cash, they still have a value which is taxable. The tax treatment depends on what the payments are for and the circumstances that apply. A brief overview Allowances There are different kinds of allowances but if it's a straightforward reimbursement to the employee for out-of-pocket work-related expenses, the allowance isn't taxable. Mileage, meals, and tools (including telecommunication devices) are examples. If the amount of the allowance is more than the actual amount of the expense, then the difference is taxable. The employee will be subject to PAYE or you will pay FBT on the difference. What about travel? Where you pay a travel allowance to an employee, you need to determine whether you are liable for FBT (if you paid for the travel) or the employee is liable for PAYE (if you reimbursed the employee’s travel costs). For a travel allowance to be tax-free, the travel must be ‘on work’ rather than just ‘getting to work’. Different factors affect the tax treatment. Can I claim GST on benefits and allowances paid to employees? You may be able to claim GST on allowances paid to employees for work-related expenses, if you are registered for GST. Keep all relevant tax invoices. You can’t claim GST for items that aren’t employment related, so this generally rules out claims on benefits. Benefits Benefits include anything that benefits the employee. They're not wages as such, but they're part of the employee's total employment package. As they're a perk of the job for the employee, you, as the employer, will usually pay fringe benefit tax (FBT) or be subject to PAYE on the value of the benefit. Benefits fall into several categories: non-cash, cash, and so-called special benefits. Holiday pay The employee is liable for PAYE on pay for annual leave and statutory holidays. Lump sum payments Pretty much anything else is classified as lump sum payments. These include bonuses, cashed-in annual leave, payments for accepting restrictive covenants, exit inducement payments, gratuities, or back pay, redundancy payments, retiring allowances, and overtime. Employees are usually liable for PAYE on these payments. Note that: the PAYE rate will vary depending on the employee's total taxable income ACC earners' levy won't apply above the maximum liable income threshold redundancy payments and retiring allowances are not subject to ACC earners' levy It can be confusing working out the tax treatment of these payments for your business. Let us know if you would like to discuss how the rules apply to your business.

11 August 2025

Unemployment in New Zealand has been steadily rising over the past two years. The unemployment rate has risen from 3.4% in Q1 of 2023, to 5.1% in Q4 of 2024. The rate has remained static for Q1 of 2025, but this prolonged rate of unemployment may be having a detrimental impact on the future of your small business. Let’s look at the alignment between unemployment and your future growth. 1. Reduced consumer spending: With more people out of work, consumers have less disposable income to play with. This leads to customers tightening their belts and less consumer spending on non-essential goods and services. This can directly impact your sales and monthly revenue, forcing you into a corner where prices (and margins) might be decreased to encourage more sales. 2. Low morale and poor employee retention: While a larger talent pool might seem beneficial, high unemployment can sometimes create a sense of job insecurity among your existing employees. Unstable economic conditions can lead to decreased morale, higher stress levels, and a potential struggle to retain top talent, who may feel less secure in their current roles. 3. Difficulty securing loans and funding: Banks become more risk-averse when there’s evidence of high unemployment, poor economic conditions and unpredictable market conditions. The recent CPA Australia Asia-Pacific Small Business Survey found that only 26.4% of Kiwi businesses expect it to be easy to access finance. Reduced access to funding can lead to poor cash flow, slower growth and an increasing need to reduce costs. 4. Decline in overall business confidence: The combined impact of poor economic conditions and high unemployment is significant. This unpredictable and unstable outlook can have a major effect on business confidence. New Zealand's ANZ Business Outlook Index fell sharply to 36.6 in May 2025 from 49.3 in the previous month. This may deter your small business from investing, innovating or expanding – all factors that could hinder your own long-term growth and stability. If you need support getting your business through the tough times – we’re here to help. There are still ways to control your spending, drive growth and do your bit to provide employment.

11 August 2025

For centuries, accounting was all about reviewing historic information – but that only told you about the past, not what was going to happen in the future. If you’re only looking back at past periods and historic numbers, this limits the insights you can achieve for your business. With a backward-looking ideology, it becomes difficult to plan, run through different scenarios or understand the path of the business going forwards. Forecasting changes this. With the right data analysis and forecasting tools, you can project sales, cash, revenue and profits into the future – and get in control of your business. A forward-looking view of your business journey Forecasting switches the focus of your financial management. By moving to a forward-looking view of your business journey, you can see further down the road – and that helps to spot any opportunities and avoid common business pitfalls. Forecasting adds value by: Highlighting the data patterns – a forecasting tool takes your historic data and projects it forward in time. This helps you and your advisers spot patterns, trends, gaps and opportunities, revealing the true ‘story’ behind your business accounts. For example, forecasting may reveal a predicted seasonal slump in the next quarter, allowing you to plan ahead and proactively take action to minimise negative impacts. Giving you a future view of your business – instinctively, business owners will look back at prior periods to assess performance. There’s value to reviewing your historic actuals, of course, but using forecasting helps you to look forward, rather than just backwards. Forecasting is the satnav, showing you the road ahead, rather than the rear-view mirror showing you the road you’ve already travelled. Helping you scenario-plan – with a financial model of your key drivers, combined with accurate forecasting, you can quick answer your burning ‘What if…?’ questions. Forecasting lets you run different scenarios, with different drivers, to see how business decisions may pan out over time. If option B performs better than option A, that’s invaluable information when defining your next strategic move. Making informed, evidence-based decisions – having ‘the full picture’ of combined historic numbers, forecasts and longer-term projections aides your business decision-making. Forecasting gives you solid evidence on which to base your strategy and helps to red flag any threats that are looming on the horizon – giving you the best possible information to keep your executive team informed and on the ball. A more effective relationship with your accountant – forecasting also helps us to get a better insight into what makes your business tick. This helps to spot potential areas of performance improvement, and to give you the best possible strategic advice, all backed up by solid, empirical data and management information. If you want to get in better control of the destiny and results of your company, we’re here to talk. Forecasting helps you highlight your future threats and opportunities – and create a proactive strategy to improve the performance of your business. It’s not always an easy process, but almost always one worth undertaking.

31 July 2025

Understanding your finances is a vital part of running your business. But getting down into the nitty gritty of your business’ financial reports isn’t every entrepreneur’s top skill. If you are new to company accounting, or simply want to expand your knowledge, this guide explains the foundational reports. The profit and loss report and the balance sheet are both key reports when it comes to getting in control of your company’s financial health. What’s a profit and loss statement? Your profit and loss statement is commonly called your P&L, but is also referred to as your income statement or statement of earnings. It’s a full breakdown of your company’s revenue (money coming into the company as sales and other business income) and your expenditure (direct costs, overheads, expenses and other costs). As a business, you obviously want to turn a profit and make money from your venture. Careful observation of your P&L allows you to track your revenues and expenses over a set period of time. You can then look back over the period and see exactly where you’re making money, and where you’re losing money. The more you make, and the less you lose, the greater your profits will be at year-end – and your P&L is your barometer for measuring these metrics. The P&L statement is good for: Giving you a breakdown of all revenues and relevant costs and expenses Showing the profit and loss figures over a set period of time Summing up your profit and loss for the period to gauge if you’re profitable. What’s the balance sheet? The balance sheet gives you a snapshot of your company’s financial health at a given point in time, based on the following accounting equation: ‘Equity = Assets - Liabilities’ The balance sheet shows you the company’s: Assets (the things the company owns, including cash) Liabilities (the things the company owes other people) Equity (retained earnings plus the funds you originally invested as shareholders) Unlike the P&L – which shows you the revenues and expenditure over the course of a given historic period – the balance sheet is best seen as a ‘screenshot’ of your current finances. In a nutshell, it shows you what the company is worth on paper right now, based on the current numbers in your business accounts. So it’s a vital tool in your accounting toolbox. The balance sheet is helpful for: Assessing the current financial position of the company Providing evidence of your financial position to banks, lenders and investors Making decisions on company dividends and related distributions Giving potential buyers an idea of the company’s tangible net asset value, if you plan to sell up. Talk to us about expanding your accounting skills If you can’t quite tell your assets from your equity, we are here to help. Accounting can be complicated and it takes time to fully grasp all the different terms and processes. We’ll be happy to run you through your latest management or statutory accounts and explain exactly what each report means – and how it reflects your current performance as a business. Get in touch with us to find out more.

15 July 2025

If you operate your business as a company, and you make a vehicle available to an employee to use privately, you’ll be liable to pay fringe benefit tax (FBT). This applies on vehicles made available to: employees (and their associated persons), and shareholder-employees (business owners) This applies whether the vehicle is actually used for private purposes or not. FBT does not apply: to vehicles that come within the definition of being ‘work related vehicles’ that are not available for private use for certain emergency calls and some out of town travel for working owners in Look Through Companies (LTCs). Instead, such benefits are treated as a distribution of profit to the working owner to the extent of the private use for sole traders and partners in a partnership. Instead, they make income tax and GST adjustments for private use. Not all ‘business’ vehicles are ‘work-related vehicles’ for FBT purposes. And some companies have other options instead of paying FBT. In some cases, exemptions apply. When is FBT payable? FBT is normally payable quarterly but can be filed quarterly, annually or by income year. Filing frequency depends on the type of company you manage, the benefits you provide and how much tax you pay. It’s important for clients to get this right because the use of, and deductions claimed for, vehicles is a common feature of any Inland Revenue review of a company’s tax affairs. You need to understand how the rules apply to your specific business. If you’re unsure and need advice, we’re here to help.

3 June 2025

Last month was Mental Health Awareness week. Being a business owner can be stressful. When the buck stops with you, it can be easy to let the pressure mount up and to discount your own wellbeing. Looking after your mental health is as important as looking after your balance sheet. That’s the reality. So, having an improved focus on rest, wellbeing and talking about your struggles is a big part of moving towards becoming a better business leader. Here are some examples: Don't overwork yourself – it's tempting to work every hour that's available in an attempt to meet your goals. But working yourself into the ground is, ultimately, a destructive thing to do. If you're tired and burnt out then you're in no position to lead the company. Try to stick to set working hours and avoid working 60-hour weeks wherever possible. Sleep, rest, and downtime are vital. Schedule time for non-work-related activities – make sure you have time blocked out for things that aren't work. That might be a walk in the countryside, time with your kids, or a game of tennis. The aim is to take yourself away from the stresses of the business and to give yourself a broader life outside the company. It's a chance to have fun, to relax, or to be someone who isn't just 'the boss'. Take up an activity that promotes wellbeing – there are plenty of pastimes that can help you bring down your anxiety levels and bring you to a calmer place. Yoga is a good way to stay fit, but also an excellent form of relaxation. Equally, finding time for meditation helps you to empty your mind of business concerns and allows you to become more grounded and calmer. Even something as traditional as a fishing trip could help you to chill out and relax away from a screen. Talk about your worries, concerns, and anxieties – if business-related stress is building up, the worst thing you can do is keep it all bottled up. It's beneficial to open up and talk about these issues. This could be with a partner, a fellow entrepreneur, your accountant, or even a professional counsellor. Be transparent about your state of mind and you’ll find people are more than willing to listen, understand, and offer some support. Finally, as accountants and advisers, we’re in a good position to help when you need someone to open up to about your business concerns.

3 June 2025

About the standards. The healthy homes standards, which became law on 1 July 2019, introduced minimum standards for heating, insulation, ventilation, moisture ingress and drainage, and draught stopping in rental properties. Landlords are responsible for ensuring their properties meet the standards and continue to do so over time. When you need to meet the standards. All rental properties will need to comply with the healthy homes standards by 1 July 2025. You must make sure that your rental meets the standards within certain time frames. The time frame depends on what type of tenancy it is, or when a new tenancy starts or is renewed. What happens if you don’t meet the standards. Landlords who don't meet their obligations under the healthy homes standards are in breach of the Residential Tenancies Act 1986 – and may face consequences, like financial penalties. What to include in the tenancy agreement. New or renewed tenancy agreements must include a signed statement with details of the property’s current level of compliance with the standards. What records to keep. Landlords must keep all records and documents that show how they are complying with the healthy homes standards. These must be made available on request – for example, to the Tenancy Tribunal, or the Tenancy Compliance and Investigations team. Landlords are committing an unlawful act if they don’t supply the records within 10 working days of a request, and do not have a reasonable excuse. Tenants can also request information about compliance with the healthy homes standards. Landlords must provide this information to tenants within 21 days.

3 June 2025

Are you renting accommodation from your home, through Airbnb or some other way? For tax purposes, short-stay or holiday accommodation is treated differently from accommodation provided to tenants, boarders, or care home residents, or from student or emergency accommodation. A short stay is anything up to four consecutive weeks. The tax rules are different depending on whether you’re hosting guests in your own home, or on a separate property at your place, such as a sleepout, or at your holiday home or bach. If you host guests in your own home, whether in one or more rooms, or the whole home, income from it is taxable. You can claim deductions for costs related to the rental. If you do, Inland Revenue will want to know that you are only claiming for costs related to the rental and not for costs incurred because of your own household use.

3 June 2025

As the owner of a family farm, you’re not just running a business - you’re responsible for the future of the family’s legacy, and the financial security of your nearest and dearest. You’re also the custodian of the land, livestock, and environment that makes up your land. So, do you have a plan in place for handing over this vital asset when you choose to retire? With the average age of Kiwi farmers now at 58 years old, it’s important to think about succession planning and how the farm will be passed on to the next generation. With the demands of running and operating the farm at the forefront of your mind, it can be a challenge to find time to work on the business, and to outline your future plans as a family. But having a succession plan is a critical part of your farm strategy and planning. We’ve outlined five key areas you should have on your radar when it comes to getting a clear, workable, and effective succession plan in place. Family dynamics Sit down regularly to talk through the family’s plans for the farm, and the careers and aspirations of each family member that works in the business. This means addressing those all-important family relationships, expectations, and facing any potential conflicts head-on to ensure a smooth transition. Business valuation The farm is a critical business asset, so it’s important to get an accurate valuation of the whole business. This allows you to determine a fair and equitable transfer price to your successor, or to have a fair market price when selling up. Financial planning The business you hand on needs to be financially viable, while also providing for your own retirement. You’ll need a comprehensive financial plan to cover retirement expenses, estate taxes, and potential debt restructuring. Legal and tax implications Partnering with legal and tax advisers helps you avoid any major problems further down the line. Work with your advisers to understand the implications of different succession strategies and the impact they will have for you, your successor, your family, and the business as a whole. Retirement planning Develop a retirement plan for yourself and the current generation of family members. This means assessing your lifestyle considerations, personal retirement goals, and the financial stability you and your family will need once you step back from the farm and ownership of the business. If you need help, we’d love to talk to you about developing a succession plan for your farm and setting the best possible foundations. Succession planning should be at the top of your to-do list.

26 May 2025

The 2025 New Zealand Budget has introduced a significant incentive aimed at boosting business investment: a 20% immediate deduction on capital spending . This measure is set to provide a timely advantage for small businesses and primary producers—particularly farmers who have enjoyed strong payout seasons in recent years. For both groups, the combination of higher returns, aging equipment, and the need to stay competitive has created the perfect conditions to reinvest. Under the new policy, eligible capital expenditure can be immediately reduced by 20% for tax purposes, with the remainder depreciated over time. This not only improves cash flow in the short term but also provides a strong incentive to accelerate long-needed upgrades. Whether it’s new machinery, technology systems, infrastructure, or specialist equipment, the opportunity to reduce taxable income while modernising operations is likely to resonate with businesses across New Zealand. The timing couldn’t be better. With Fieldays coming up in June in Hamilton , many businesses and farmers will be engaging with suppliers, exploring the latest products, and making purchasing decisions. This new tax deduction could make those investments significantly more attractive—and more affordable. With the agriculture sector under pressure to maintain productivity and meet rising environmental standards, and small businesses looking for ways to scale or modernise, this policy could also help fast-track the adoption of more efficient, sustainable technologies. In practical terms, a $200,000 investment in new equipment could reduce taxable income by $40,000 under the new scheme—a substantial financial incentive for those considering capital purchases. For both small business owners and farmers, 2025 may be the ideal time to act.

6 May 2025

Business confidence is a key economic indicator, and right now in New Zealand, the latest data is showing some positive signs: Signs of recovery – After a slow period, economic activity has started to pick up with early signs of renewed business momentum. Cautious optimism – Business confidence is improving, but caution lingers as companies navigate costs, demand, and future economic uncertainty. Global uncertainty – While domestic trends are improving, global trade tensions and price volatility could still impact supply chains, costs, and long-term stability. Use the current business confidence to your advantage In any economic environment, the key is to adapt and adjust to protect and future-proof your business: Consider your growth strategy. If confidence continues to rise, now could be a good time to expand your operations, invest in new equipment, or explore new revenue streams. Hiring and workforce planning. Business optimism often fuels recruitment and team expansion. Confidence is on firmer ground, but uncertainty remains. If hiring, focus on roles that support long-term growth. If caution is needed, consider upskilling existing staff instead. Market positioning. Shifting confidence levels can change customer spending habits. Are there opportunities to refine your pricing, enhance your marketing efforts, or introduce premium services that align with shifting demands? Financing decisions. If borrowing costs continue to ease, consider refinancing loans at a lower rate or securing funds for expansion—just make sure you weigh affordability before taking on new debt. Understanding the current business climate is key to making informed financial decisions. Want tailored insights for your industry? We’re here to help.

5 May 2025

At Diprose Miller, we work with a diverse range of clients and industries—but when it comes to agribusiness, we bring a depth of expertise that truly sets us apart. Our team includes professionals with strong backgrounds in the sector, allowing us to bring together a cross-functional group focused on providing tailored support for agribusiness clients. By working seamlessly together and sharing knowledge, we deliver practical, forward-thinking solutions that meet the unique needs of rural businesses. We're proud to offer exceptional service built on collaboration, industry insight, and a genuine understanding of the challenges and opportunities in agribusiness. Why Agribusiness is Unique Agribusiness is unlike any other sector. It demands specialised knowledge in areas like banking requirements, tax compliance, market trends, and risk management. There are specific challenges unique to this field, and having professionals working in agribusiness every day gives us the insight and expertise to truly support our clients. My family has vested and lifetime interest in this industry, which adds another level of understanding and connection throughout the ever-changing seasons. Whether it’s navigating regulations or planning for future growth, our experienced team is here to help agribusinesses thrive. A Fun Side to the Team It’s not all hard work and no play! One of my favourite Diprose Miller team traditions is our Secret Santa gift exchange. I’ll never forget being the first “newbie” to receive a less-than-ideal present—an ongoing joke that continues to bring laughter to our team even now. Moments like these remind me how much I enjoy being part of such a fun and close-knit group. At Diprose Miller, we’re passionate about helping agribusinesses succeed. If you’d like to learn more about how we can support your business, feel free to reach out.

25 March 2025

We are extremely proud to announce the appointment of Melissa Slattery as a director, effective from 1 April 2025. Melissa will join our leadership team alongside Ed, Jeanette, Darren, and Sharon. Her appointment is a testament to her expertise in agricultural business and reinforces our commitment to providing top-tier service to our clients in the farming sector and the dairy industry in particular. Melissa has a wealth of real-life experience in these areas. She understands the challenges her clients face and has a vested interest in their success. Melissa’s approach goes beyond just looking at numbers; she relates them to the current business environment while maintaining a forward-looking perspective. Her ability to put figures into context with what’s happening today, while focusing on tomorrow, is invaluable. Melissa has clients all over New Zealand, utilising the latest technology to ensure they receive the best service. She works with farmers from the far north to Southland and recently ventured down to Murchison on a Sunday to see clients. This dedication highlights her commitment to providing exceptional service regardless of location. Her colleagues have expressed high regard for her expertise and practical advice. “Melissa brings an extensive knowledge of the dairy and farming business and is best placed to provide practical advice for growth and sustainability,” noted Director Ed Wagstaff. This sentiment captures Melissa’s essence—she offers insightful, growth-oriented advice that drives success for our clients. Melissa is dedicated to helping her team and clients achieve their goals. She enjoys working closely with them to truly understand their businesses and assist in solving problems. Her collaborative approach ensures that she can offer tailored solutions that foster growth and resilience. As she steps into her new role, Melissa is eager to support the firm and its clients in their future growth endeavours. Her passion for helping others and her commitment to excellence align perfectly with our values and mission here at Diprose Miller. Outside of her professional life, Melissa values family time. She loves exploring the great outdoors, discovering new places, and taking the opportunity to unwind and relax. She calls herself an ‘active rester’ as she enjoys chasing a ball—in particular, netball, volleyball, and squash—though currently she is recovering from a knee injury. We are excited to welcome Melissa to our leadership team and are confident that her expertise and dedication will have a significant positive impact on our firm and clients. Melissa’s appointment marks a new chapter for us, and we look forward to the continued growth and success that she will help drive.

25 March 2025

Over the last few months, we’ve had a number of clients contacted by scammers pretending to be representing Inland Revenue, usually via email. To be safe, we recommend that our clients never respond directly to requests from Inland Revenue. As your nominated tax agent, we should be the first point of contact for Inland Revenue staff. In most cases, genuine Inland Revenue requests can be dealt with without the client needing to be involved. Often the language used in the email, together with the domain name of the sender, will provide a strong hint that an email is a scam. However, the scam emails are becoming more sophisticated over time and less likely to arouse suspicion. The “golden rule” is easy to remember – refer any Inland Revenue queries and/or requests directly to us.

25 March 2025

There are changes to the reporting standards for charities that administrators for charitable entities need to become familiar with. For reporting periods ending on or after 31 March 2025 , the new “Tier 4 (NFP)” standard will be compulsory for annual returns filed with Charities Services. This standard replaces the existing “PBE SFR C (NFP)” standard that currently applies. Both standards apply where cash-based reporting is used. An equivalent change applies to charities required to use accrual (non-cash) based reporting, with a new “Tier 3 (NFP)” applying. The changes are not significant. They simplify the content of the Statement of Service Performance and the Statement of Resources & Commitments and amend the standard reporting categories for receipts and payments for Tier 4 (or income and expenses for Tier 3). Guidelines for the new standards and their application can be found at www.charities.govt.nz/reporting-standards/about . If you’re responsible for annual reporting for a charity, contact us to check how these changes will apply to you.